The smart Trick of Worker's Compensation That Nobody is Talking About

Wiki Article

Rumored Buzz on Worker's Compensation

Table of ContentsSome Known Incorrect Statements About Worker's Compensation 8 Simple Techniques For Worker's CompensationThe Ultimate Guide To Worker's CompensationUnknown Facts About Worker's CompensationThe smart Trick of Worker's Compensation That Nobody is Talking AboutLittle Known Questions About Worker's Compensation.Worker's Compensation Fundamentals Explained

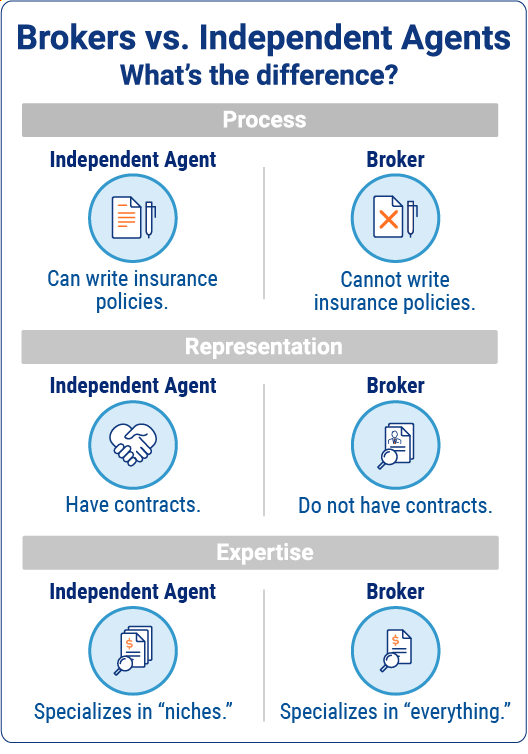

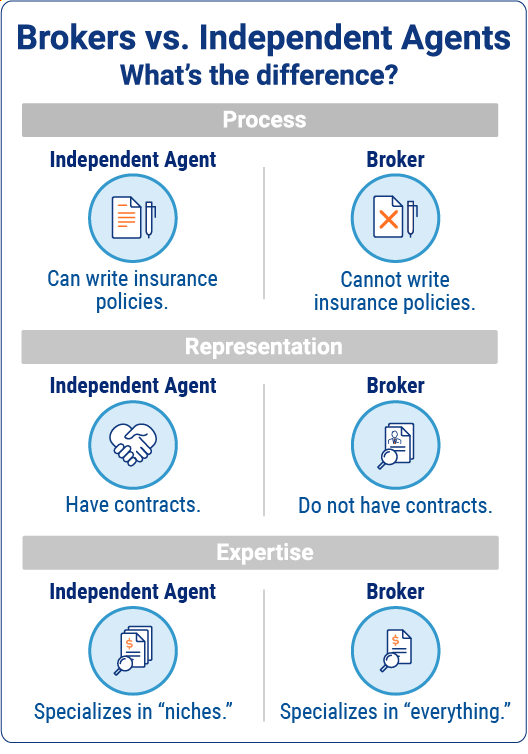

Insurance brokers stand for customers, not insurance coverage firms; for that reason, they can not bind insurance coverage on behalf of the insurance firm. That's the function of insurance representatives, who stand for insurance coverage firms and can complete insurance sales., depending on state policies. When you work with an insurance coverage broker, they function straight for you. An insurance agent, on the other hand, usually works on behalf of an insurance coverage business.

An insurance coverage broker can not shut an offer on a policy, only an agent or an insurance policy company can. Insurance coverage brokers need a state certificate to exercise.

Worker's Compensation Things To Know Before You Buy

In enhancement to connecting customers to the appropriate policy, the broker proceeds to have responsibilities to his customers. A broker gives consultatory solutions to assist customers submit cases and also get benefits, in enhancement to establishing whether policies need to be transformed. Worker's Compensation.

Insurance policy brokers can handle as several types of insurance as they are comfy selling, ending up being an expert in one might be beneficial. Brokers have to be licensed in the state where they practice and also pass Series 6 and also 7 FINRA-administered examinations. Maintaining up to day on modifications in insurance policy regulations is a great way to maintain clients positive.

The 7-Second Trick For Worker's Compensation

They work as an intermediary in between their clients and also insurance policy companies. There are many types of insurance as well as insurer that it can be difficult to do enough research study in order to make a sensible choice for your needs as well as spending plan. An insurance policy broker takes duty for the study as well as assists lead their clients to make the best choice, making a payment in the procedure.Materials In the USA, brokers are managed by the state (or states) in which they work. A lot of brokers are needed to have an insurance policy broker certificate, which involves enrolling as well as passing an exam. Each state has different requirements for insurance brokers, which a broker needs to satisfy to be licensed in that state.

This is a broker's task: to assist clients comprehend the obligations that they have and also exactly how those risks can be sufficiently taken care of through insurance policy. Brokers can after that help customers review a number of insurance coverage alternatives to select the policy and premium that best fits their needs as well as budget. Many people know with or have actually collaborated with an insurance coverage agent eventually in their lives.

Everything about Worker's Compensation

A broker working with a business to acquire workers' payment insurance coverage can initially examine the type and also degree of protection needed (which might be established in component by state regulation). The broker can then provide a range of alternatives from a number of insurance firms, and also aid business pick the policy that supplies one of the most insurance coverage at the very best rate.This consists of advising clients on technical issues that might be handy on the occasion that a client has to file a case, assisting customers decide if they need to transform their insurance coverage or insurance coverage, as well as also making certain that clients adhere to their policy's needs. Insurance policy brokers work for their clients, they aren't paid by them.

The compensation is a percent of the costs cost and varies by state law - Worker's Compensation. It usually is in between 2 and also eight percent of the premium. If you deal with a broker to get house owners, auto, health, service, life or any other kind of insurance coverage, you will certainly not pay them a charge for the solutions they supply.

How Worker's Compensation can Save You Time, Stress, and Money.

For most consumers as well as local business owner, utilizing an insurance broker is usually more suitable to getting insurance policy via an agent or buying insurance coverage by yourself. Collaborating with a broker can conserve you money and time as well as most importantly can result in far better insurance policy coverage. Brokers are typically able to improve rates on insurance coverage for their clients than individuals getting insurance policy straight from the business.

Insurance holders who used brokers are less most likely to make unneeded cases or to be under insured, which inevitably conserves the insurance business money. The companies usually supply special broker prices as an outcome so that broker clients have reduced cost alternatives readily available to them. While representatives may additionally obtain unique prices, they are benefiting the insurance provider except you.

Some Known Questions About Worker's Compensation.

Using a broker can likewise simplify the process of choosing insurance coverage. There are so many different options for insurance, with various limits and exemptions for each plan.Whether you are concerned about your company being sued for marketing a malfunctioning product or concerning what would certainly take place if you had a fire at your house, an insurance policy broker can attend to each of these problems as well as browse around this site can build an extensive insurance coverage strategy to make certain that every one of your responsibilities concerns is attended to.

Due to the fact that a broker benefits you not for an insurance provider you can be assured that your insurance broker has your ideal rate of interests in mind when purchasing insurance plans. Call an insurance policy broker today for more information concerning just how she or he can help you buy the best possible insurance coverage for your needs.

Things about Worker's Compensation

When getting insurance, it's smart to obtain quotes from several insurance providers to discover the finest price. While practically any individual can contrast rates online, in many cases it makes good sense to have a specialist stroll you via your choices. Easily contrast individualized prices to see just how much changing automobile insurance policy could save you.

Report this wiki page